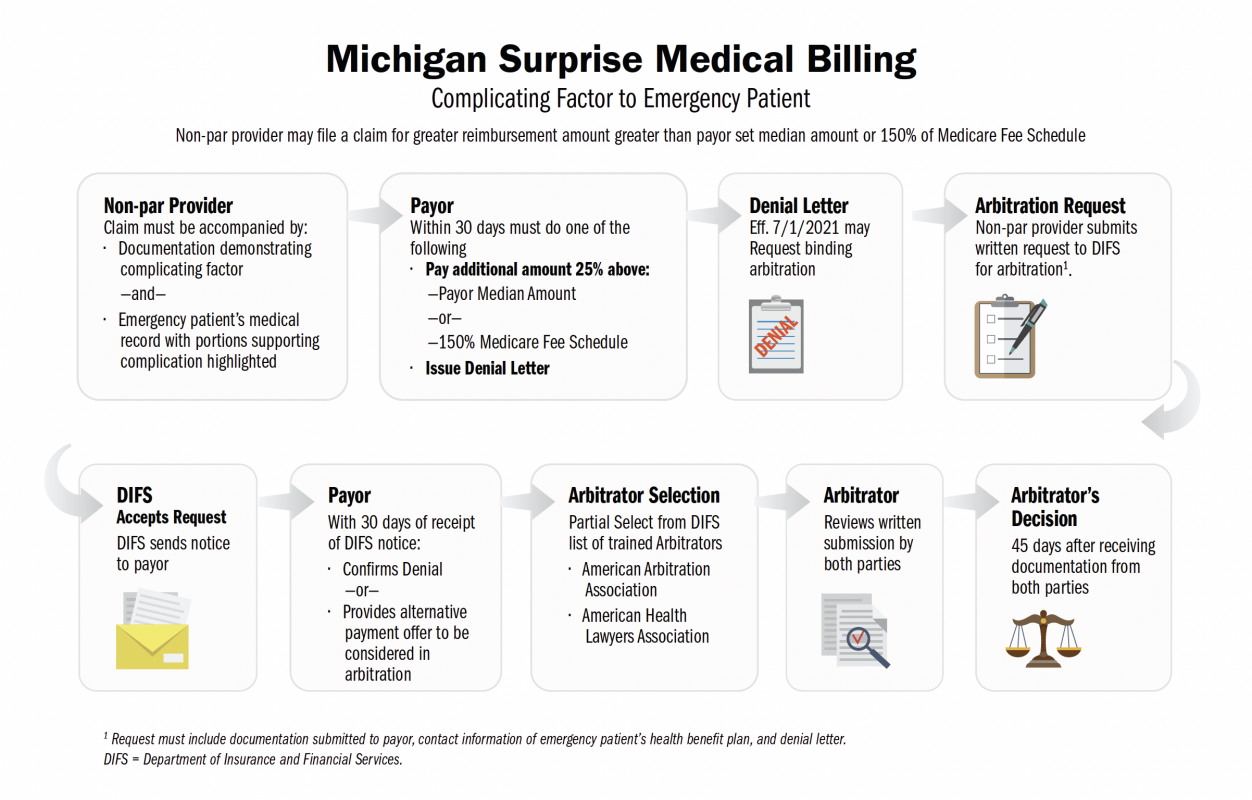

On October 22, 2020, Michigan’s Governor Gretchen Whitmer signed the Surprise Medical Billing legislation, also known as the Surprise Billing Law. The legislation comprises of four bills (HB: 4459, 4460, 4990, and 4991) that collectively provide balance billing protections for patients.

The surprise billing law is to protect patients from surprise medical bills. A surprise medical bill is when a patient receives medical services from an out-of-network provider and receives a statement beyond an in-network amount. This is known as a surprise medical bill. It is not uncommon for a patient to receive medical services at an in-network hospital or ambulatory surgical center (ASC), and the anesthesiologist or radiologist is out-of-network. In such circumstances, the provider bills the patient for any portion not paid for by the insurance company – this is a classic surprise medical bill.